idaho sales tax rate lookup

Youll owe use tax unless an exemption applies. Local Sales.

Local Sales.

. Find your Idaho combined state and local tax rate. The base state sales tax rate in Idaho is 6. Maximum Possible Sales Tax.

The use tax rate is the same as the sales tax rate. Local tax rates in Idaho range from 0 to 3 making the sales tax range in Idaho 6 to 9. The current state sales tax rate in Idaho ID is 6.

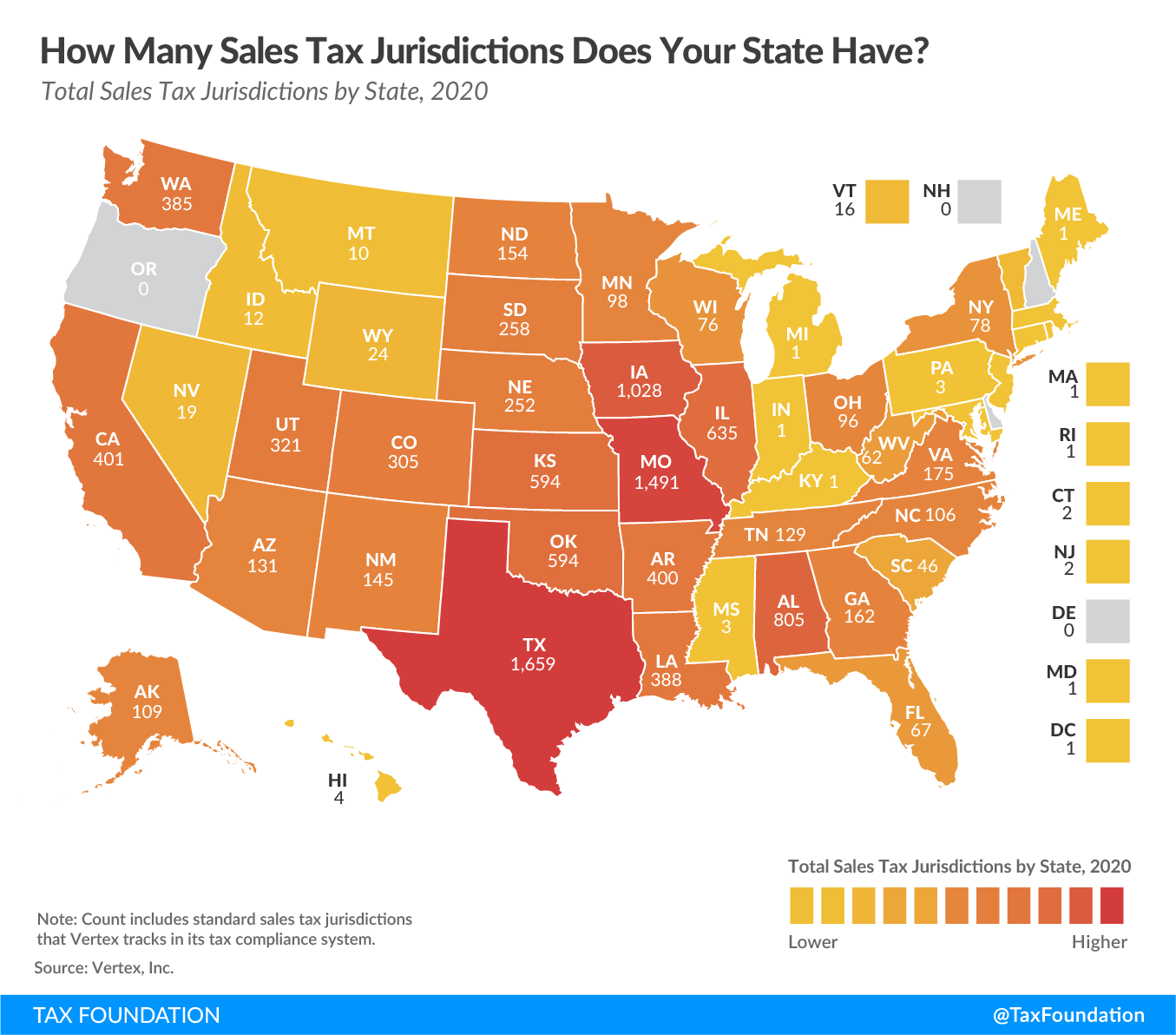

The jurisdiction breakdown shows the different tax rates that make up the combined rate. The most populous county in. Average Local State Sales Tax.

Idaho has a 6 statewide sales tax rate but also has 116 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0074 on top. Sales. This is the total of state county and city sales tax rates.

You pay use tax on goods you use or store in Idaho when you werent charged or havent paid Idaho sales tax on them. This takes into account the rates on the state level county level city level and special level. Search by address zip plus four or use the map to find the rate for a specific location.

Form ST-101 Sales Tax Resale or Exemption Certificate 07-13-2020 F. Look up a tax rate on the go. Free Unlimited Searches Try Now.

Read more in our Use Tax guide. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. Combined Sales Tax Range.

The total tax rate might be as high as 9 depending on local municipalities. 280 rows Idaho Sales Tax. 31 rows Idaho ID Sales Tax Rates by City.

The minimum combined 2022 sales tax rate for Idaho Falls Idaho is. Counties and cities can charge an. If you need access to a database of all Idaho local sales tax rates visit the sales tax data page.

The average cumulative sales tax rate in the state of Idaho is 604. Download tax rate tables by state or find rates for individual addresses. Resort cities have a choice in whats taxed and can include everything thats subject to the state sales tax.

Youll find rates for sales and use tax motor vehicle taxes and lodging tax. Prescription Drugs are exempt from the Idaho sales tax. Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3.

Seller requirem See more. Just enter the five-digit zip code of the. Depending on local municipalities the total tax rate can be as high as 9.

Idaho has a statewide sales tax rate of 6 which has been in place since 1965. The combined tax rate is the total sales tax of the jurisdiction for the address you submitted. Municipal governments in Idaho are also allowed to collect a local-option sales tax that ranges from 0.

Ad Lookup State Sales Tax Rates By Zip. Average Sales Tax With Local. What is the sales tax rate in Idaho Falls Idaho.

Local level non-property taxes are allowed within resort cities if. Sales. The Idaho ID state sales tax rate is currently 6.

Form ID ST-RR1 Worksheet Sales and Use Tax Record of Returns Filed 04-03-2020 F. The current Idaho sales tax rate is 6. The state sales tax rate in Idaho is.

Some but not all choose to limit the local sales tax to lodging alcohol. Form ST-102 Use Tax.

Sales Tax Calculator And Rate Lookup Tool Avalara

Sales Tax Calculator And Rate Lookup Tool Avalara

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Dmv Idaho Transportation Department

Idaho Sales Tax Rates By City County 2022

Idaho Property Tax Calculator Smartasset

Where S My Refund Idaho H R Block

Sales Tax Jurisdictions By State 2020 Tax Foundation

How To File And Pay Sales Tax In Idaho Taxvalet

Sales Tax Calculator And Rate Lookup Tool Avalara

Voter Guide See What S On Your Ballot For The May 2019 Election Ktvb Com

As Tax Gap Widens Idaho 1 Of 10 States With No Obligation To Disclose Property S Sale Price Idaho Capital Sun

Idaho Sales Tax Small Business Guide Truic

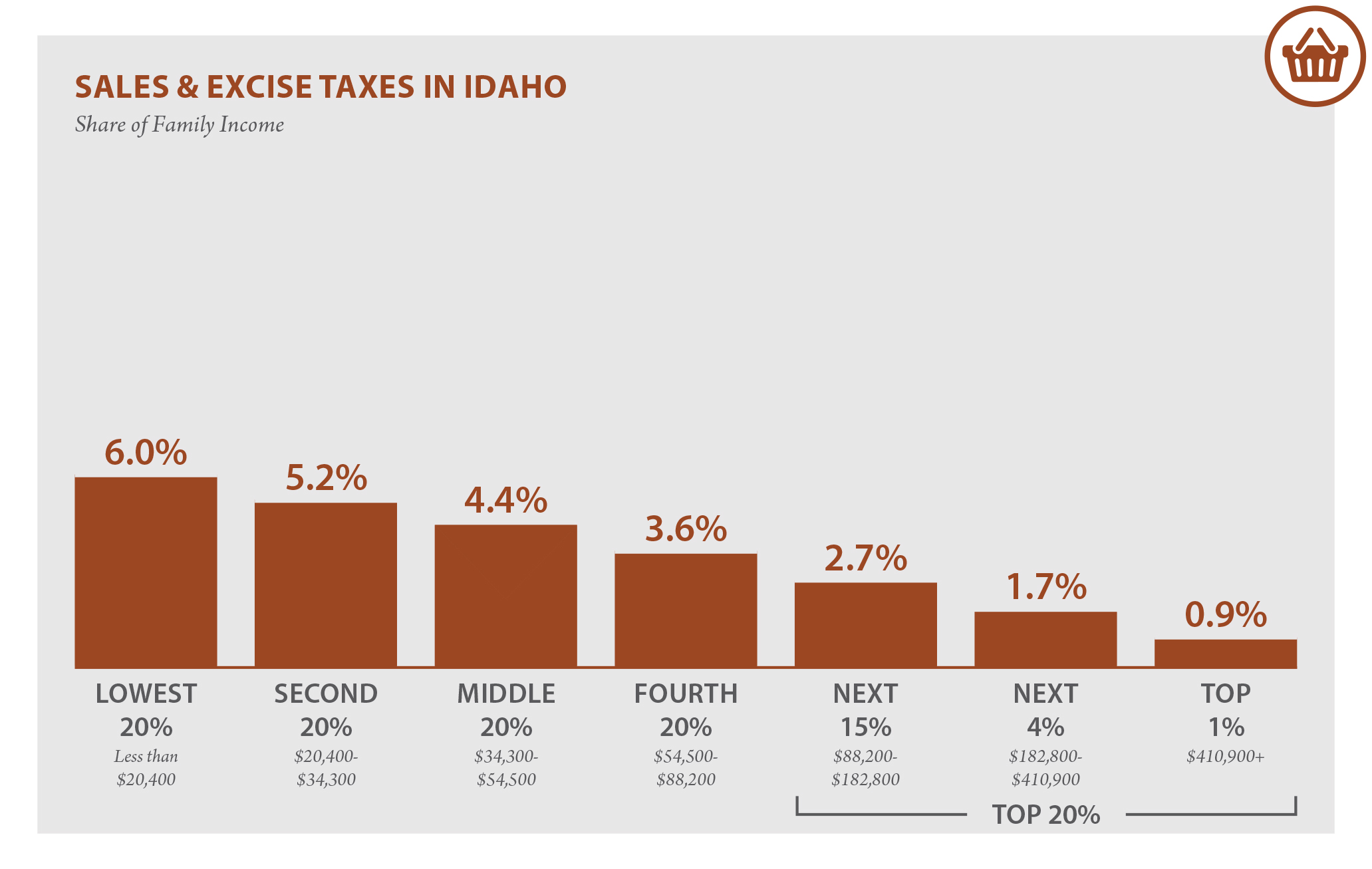

Idaho Who Pays 6th Edition Itep

Costco Sales Tax By State Check Sales Tax

Stripe Tax Automate Tax Collection On Your Stripe Transactions

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation