do pastors file taxes

However certain income of a church or religious organization may be subject to. Organizations are generally exempt from income tax and receive other favorable treatment under the tax law.

If They Re So Interested In Getting Into Politics And Telling Us How To Live Our Lives Let Them Pay Taxes Like The Rest Of Us Fix It Jesus Pastor Politics

While they can be considered an employee of a church for federal income tax purposes a pastor is considered self-employed by the IRS.

. First of all the answer is no churches do not pay taxes Churches do enjoy tax-exempt status with the Internal Revenue Service. Their wages are very low. A pastor has a unique dual tax status.

Ad Specializing in tax preparation for clergy and those with special tax needs. Taxes for pastors basically boils down to being considered self-employed by the IRS and self-employed tax returns are our specialty. See If You Qualify and File Today.

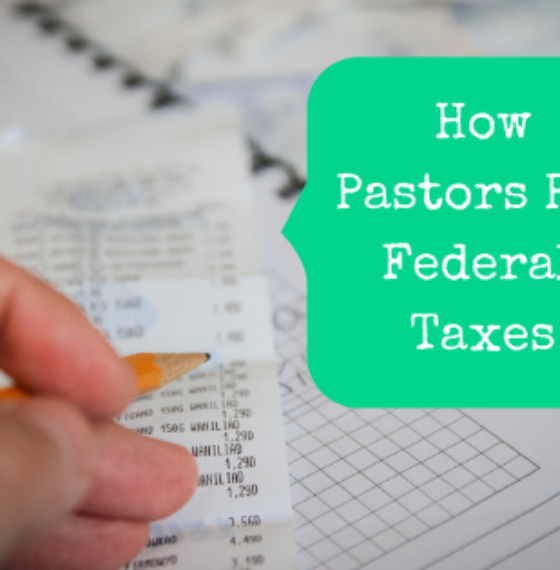

In fact not only do they not have to withhold taxes but churches arent allowed to withhold Social Security and Medicare taxes also called FICA or payroll taxes. To make the request fill out and mail Form 4361 Application for Exemption from Self-Employment Tax for Use by Ministers Members of Religious Orders and Christian Science. Ministers generally pay the same taxes as everyone else with some exceptions.

Regardless of the employment status of a pastor Social Security and Medicare cover services performed by that pastor under the self-employment tax system. They pay no income taxes on their qualified housingparsonage and utility allowance. Free FederalFederal Tax Filing.

A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self. Our software walks you through the process to quickly file your tax return. Here are the seven factors that they look at.

Clergy Tax Preparation and clergy tax tools to answer your questions. Ad E-File Free Directly to the IRS. They must pay SE taxes on their housingparsonage and utility allowance.

Pastors are not tax-exempt though part of a ministers income may be. The US Tax Court has developed a 7-factor test to determine when a pastor really is self-employed for federal income tax purposes. They are considered a common law employee of the church so although they do receive a W2 their income is reported in different ways.

For a payment to qualify for the income tax exclusion the. Pastors who work for. This exemption applies only for income tax purposes.

A brief description of annual filing requirements for tax-exempt churches and. Pastors may voluntarily choose to ask their. Pastors may choose to allow the church to compute and withhold Social Security and Medicare taxes but they are responsible for filing these taxes themselves.

What this means is that churches do not pay corporate taxes. Ad File For Free With TurboTax Free Edition. When you file your minister tax return with.

For services in the exercise of the ministry members of the clergy receive a Form W-2 but do not have social security or Medicare taxes withheld. Unrelated business income tax requirements for tax-exempt organizations. The exclusion does not apply to self-employment taxes.

You must file it by the due date of your income tax return including extensions for the second tax year in which you have net earnings from self-employment of at least 400. Pastors fall under the clergy rules. Pastors are exempt from income tax withholding and are not obligated to have federal taxes withheld from their paychecks.

Time To Finish Up Your Taxes. Clergy Tax Preparation and clergy tax tools to answer your questions. Ad Specializing in tax preparation for clergy and those with special tax needs.

They must pay social security. Import Your Tax Forms And File For Your Max Refund Today.

Video Q A Do Pastors Really Have To Pay 15 3 For Seca The Pastor S Wallet

Tax Prep Do You Know If You Have A Tax Lien On Your Property How To Find Out Tax Help Tax Prep

Taxes For Pastors Getting The Basics

How Pastors Can Claim The Earned Income Tax Credit The Pastor S Wallet

Christian Principles For Managing Money

6 Tips How To Pay Your Pastor Minister How To Report Your Clergy Income Youtube

Huge Infographic On The Business Of Mega Churches Tax Exempt Average Pastor Income 147 000 Many In The Millions Sees Gifts Of Bentleys And Rolls Royces Attendance Growing 8 Per Year Just Take A Look

Do We Tithe Before Or After The Taxes Ask A Pastor Dr Joel C Hunter Youtube

Clergy Tax Guide Howstuffworks

Texas Pastor Worth 750m Avoids Annual 150k Tax On Mansion Report

How To Do Taxes Form 1040 Pastor Taxes Edition Youtube

Why The Tax Exempt Mansion Of Kenneth Copeland Is Under Scrutiny Again

How Pastors Pay Federal Taxes The Pastor S Wallet

How Will A Biden Presidency Affect Taxes For Pastors The Pastor S Wallet

Tax Preparation For Pastors And Clergy Tax Preparation Our Services